Govt borrows to repay debt: report

Pakistan has slipped into a debt trap due to the government’s failure to bring reforms and weak fiscal management, which has also raised national security concerns, says a report of a think tank being run by a ruling party leader.

“We are in a debt trap that is entirely of our own making. It is a risk to our national security,” said a brief report of the Institute of Policy Reforms (IPR). The IPR paper titled “Pakistan’s debt and debt servicing is cause for concern”, underlined that the government was borrowing to repay the maturing debt.

Pakistan Tehreek-e-Insaf’s (PTI) senior leader and former commerce minister Humayun Akhtar Khan is the chairman and chief executive officer of IPR. Among its board of advisers are Sikander Afzal, Dr Manzoor Ahmad, Syed Yawar Ali and Hussain Haroon.

This adds to criticism against the growing public debt, which now seems to be a concern for all political parties, businessmen and experts.

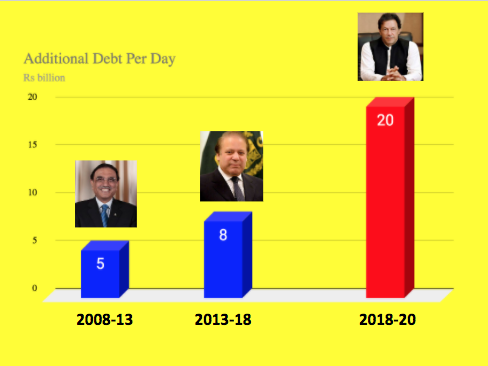

The report underlined that in last fiscal year 2019-20 alone, Pakistan added a total of Rs4.3 trillion to its debt and liabilities. It was equal to 10.4% of the country’s gross domestic product (GDP). “In two years, total debt and liabilities have grown by a massive Rs14.7 trillion.

This shows weak fiscal management as well as inability to stimulate growth in the productive sectors,” said the report. “It also reflects a failure to make the necessary reforms in key sectors of energy and power.”

In the last fiscal year ended June 2020, Pakistan’s total debt and liabilities stood at 107% of GDP or Rs44.5 trillion while gross public debt was equal to 87% of GDP. The IPR stated that while the government often attributed the increase in debt to exchange value changes, the picture was more complex. Domestic debt has grown at an equal pace and external debt has also grown in US dollars.

“The increase in domestic debt is because of weak FBR revenue collection, where attempts to reform may have had the opposite effect of what was intended,” said the report.

However, the Ministry of Finance insists that public debt management improved in the last fiscal year after a significant deterioration in the first year of PTI government. It blamed the previous government for leaving behind a huge debt pile, which increased the cost of debt servicing.

The IPR also came down hard on the central bank’s monetary policy, saying it did not have an economic logic. “High discount rate, with no apparent economic logic, slowed down the economy, and with it tax revenue,” it said.

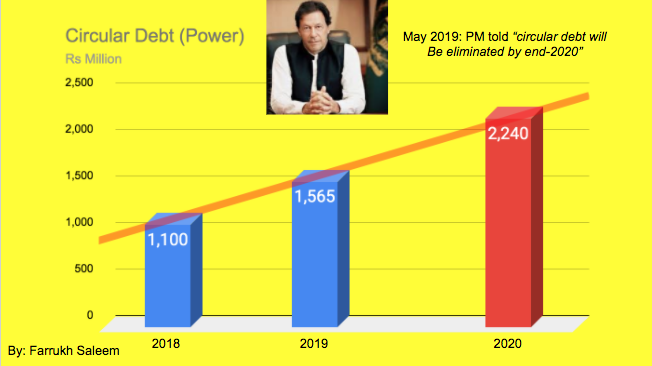

Despite increase in power tariff, revenue collection by distribution companies did not improve, said the think tank. Consequently, in addition to government borrowing, public sector entities’ (PSEs) debt also increased. The PTI government has increased power tariffs by more than half in the past almost two years and yet the circular debt has touched the new historic high of Rs2.4 trillion. The International Monetary Fund is again demanding an increase in power tariffs as part of its solutions to the power sector problems.

The IPR said the gross public external debt grew 13% in the first year of PTI and 5.4% in the last fiscal year.

In the last five years or so, the source of funds shifted from concessionary long tenure multilateral and Paris Club loans to higher-cost commercial and other bilateral loans. This raised the average cost of debt and reduced its tenure.

The IPR finds a silver lining in the deteriorating debt situation. It said the government took a wise course of paying back costly commercial funds and bonds by taking multilateral loans in the last fiscal year. “Yet, the debt sustainability indicators are on the decline,” it added.

The government’s external debt and liabilities amounted to $95 billion in 2018, which increased to almost $113 billion by the end of last fiscal year. Pakistan added $17.8 billion to the total external debt and liabilities in two years.

By June 2020, the country’s external debt and liabilities was 45% of GDP. The number stood at 30% of GDP in 2018 and 25% in 2013, it added.

As the debt is used mostly for balance of payments and budgetary support, there was no way of knowing how it would be paid back, said the IPR, which was also a sign of digging deeper into the debt trap.

“Pakistan has always been care free in taking foreign loans,” said the think tank. Debt servicing has claimed an increasing share of the country’s forex resources. In the last fiscal year, debt servicing reached a high of $14.6 billion, which was equal to 5.4% of GDP and more than half of total export earnings.

About 73% of interest and 84% of principal is to service public debt. “At this level of repayment and with scant addition to exports, as total debt continues to grow, its sustainability becomes a huge concern,” said the IPR.

Published in The Express Tribune, October 21st, 2020.

https://tribune.com.pk/story/2269212/govt-borrows-to-repay-debt-report