RiazHaq

Senator (1k+ posts)

http://www.riazhaq.com/2014/09/does-china-seek-to-dominate-india.html

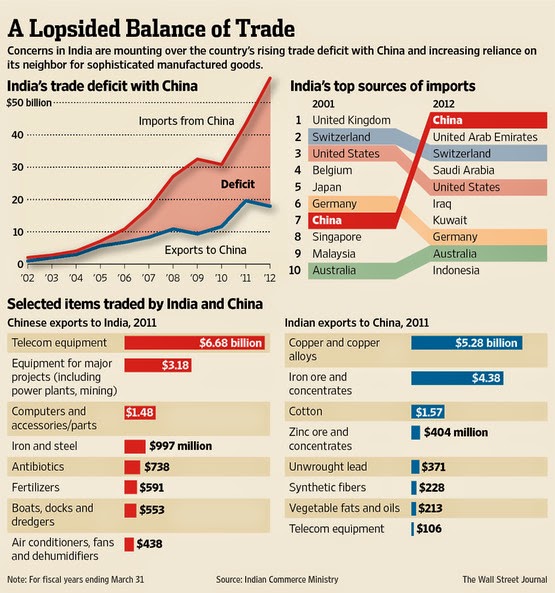

A new study shows that China is now India's top trading partner, edging out the United Arab Emirates—India’s previous top trading partner—and is comfortably ahead of the US and Saudi Arabia. India-China annual trade volume now adds up to about $70 billion, and India is running a massive $40 billion trade deficit with China. China exports high-value, high-tech machines to India while India exports low-value commodities to China.

Chinese Infrastructure Loans to India:

China's state-owned banks are financing huge infrastructure projects in Africa and India to boost Chinese exports. Leading the effort are China's ExIm Bank, China Development Bank and China Industrial Commercial Bank. Major multi-billion dollar projects being signed by Chinese President Xi Jineng, currently visiting India, and Prime Minister Modi will be financed by loans from one or more of the state-owned Chinese banks.

Chinese Infrastructure Project Financing in Pakistan:

China is also pursuing strategic Pakistan-China economic corridor which includes several large infrastructure projects worth tens of billions of US dollars connecting China with the Arabian Sea through Pakistan. These projects will be financed by China's ExIm Bank and other state-owned banks.

In a report last year, China's State-owned Xinhua News Agency articulated China's motivation to expand land trade in addition to building its navy to protect its sea trade. Here's what it said:

“As a global economic power, China has a tremendous number of economic sea lanes to protect. China is justified to develop its military capabilities to safeguard its sovereignty and protect its vast interests around the world."

China's Global Superpower Ambitions:

The Xinhua report has for the first time shed light on China's growing concerns with US pivot to Asia which could threaten China's international trade and its economic lifeline of energy and other natural resources it needs to sustain and grow its economy. This concern has been further reinforced by the following:

1. Frequent US statements to "check" China's rise. For example, former US Defense Secretary Leon Panetta said in a 2011 address to the Naval Postgraduate School in California: "We try everything we can to cooperate with these rising powers and to work with them, but to make sure at the same time that they do not threaten stability in the world, to be able to project our power, to be able to say to the world that we continue to be a force to be reckoned with." He added that "we continue to confront rising powers in the world - China, India, Brazil, Russia, countries that we need to cooperate with. We need to hopefully work with. But in the end, we also need to make sure do not threaten the stability of the world."

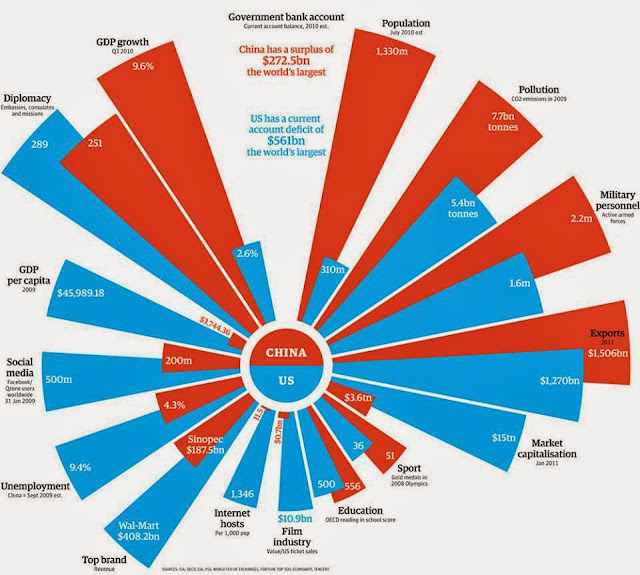

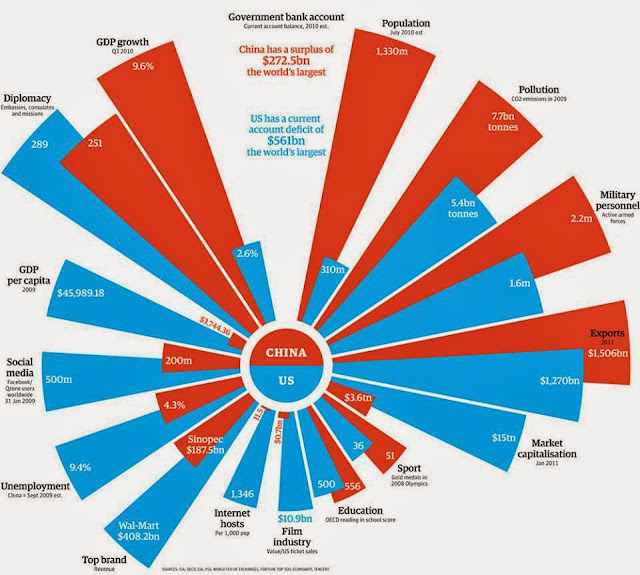

[TABLE="class: tr-caption-container"]

[TR]

[TD="align: center"] [/TD]

[/TD]

[/TR]

[TR]

[TD="class: tr-caption, align: center"]Source: The Guardian[/TD]

[/TR]

[/TABLE]

2. Chinese strategists see a long chain of islands from Japan in the north, all the way down to Australia, all United States allies, all potential controlling chokepoints that could block Chinese sea lanes and cripple its economy, business and industry.

[TABLE="class: tr-caption-container"]

[TR]

[TD="align: center"] [/TD]

[/TD]

[/TR]

[TR]

[TD="class: tr-caption, align: center"]Karakoram Highway-World's Highest Paved International Road at 15000 ft.[/TD]

[/TR]

[/TABLE]

Chinese Premier's emphasis on "connectivity and maritime sectors" and "China-Pakistan economic corridor project" is mainly driven by their paranoia about the US intentions to "check China's rise" It is intended to establish greater maritime presence at Gwadar, located close to the strategic Strait of Hormuz, and to build land routes (motorways, rail links, pipelines) from the Persian Gulf through Pakistan to Western China. This is China's insurance to continue trade with West Asia and the Middle East in case of hostilities with the United States and its allies in Asia.

[TABLE="class: tr-caption-container"]

[TR]

[TD="align: center"] [/TD]

[/TD]

[/TR]

[TR]

[TD="class: tr-caption, align: center"]Pakistan's Gawadar Port- located 400 Km from the Strait of Hormuz[/TD]

[/TR]

[/TABLE]

As to the benefits for Pakistanis, expanded trade and the Chinese investment in "connectivity and maritime sectors" and "China-Pakistan economic corridor project" will help build infrastructure, stimulate Pakistan's economy and create millions of badly needed jobs.

Clearly, China-Pakistan ties have now become much more strategic than the US-Pakistan ties, particularly since 2011 because, as American Journalist Mark Mazzetti of New York Times put it, the Obama administration's heavy handed policies "turned Pakistan against the United States". A similar view is offered by a former State Department official Vali Nasr in his book "The Dispensable Nation".

Chinese Checkbook Diplomacy:

China is now the biggest lender to the developing world, surpassing the World Bank set up as an institution by the West to extend its dominance after WWII. China's checkbook diplomacy is bearing fruit with its growing trade making it the biggest trading partner of a growing number of countries and regions. As China surpasses the United States as the largest economy and its trade volume explodes, it is very likely that the RMB (Yuan), the Chinese currency, will replace the US dollar as the world's main trade and reserve currency.

Between 2001 and 2010, China’s Export-Import Bank extended $62.7 billion in loans to African nations, or $12.5 billion more than the World Bank, according to Forbes magazine. Over the same period, trade between Africa and China grew by more than 700 per cent with China replacing the U.S. as Africa’s biggest trading partner in 2009.

Summary:

History is filled with examples of great powers using trade and exports to extend their power and influence across the world. China appears to be taking a page from their playbook in pursuit of massive trade growth through check-book diplomacy in Africa, South Asia and South America.

http://www.riazhaq.com/2014/09/does-china-seek-to-dominate-india.html

A new study shows that China is now India's top trading partner, edging out the United Arab Emirates—India’s previous top trading partner—and is comfortably ahead of the US and Saudi Arabia. India-China annual trade volume now adds up to about $70 billion, and India is running a massive $40 billion trade deficit with China. China exports high-value, high-tech machines to India while India exports low-value commodities to China.

Chinese Infrastructure Loans to India:

China's state-owned banks are financing huge infrastructure projects in Africa and India to boost Chinese exports. Leading the effort are China's ExIm Bank, China Development Bank and China Industrial Commercial Bank. Major multi-billion dollar projects being signed by Chinese President Xi Jineng, currently visiting India, and Prime Minister Modi will be financed by loans from one or more of the state-owned Chinese banks.

Chinese Infrastructure Project Financing in Pakistan:

China is also pursuing strategic Pakistan-China economic corridor which includes several large infrastructure projects worth tens of billions of US dollars connecting China with the Arabian Sea through Pakistan. These projects will be financed by China's ExIm Bank and other state-owned banks.

In a report last year, China's State-owned Xinhua News Agency articulated China's motivation to expand land trade in addition to building its navy to protect its sea trade. Here's what it said:

“As a global economic power, China has a tremendous number of economic sea lanes to protect. China is justified to develop its military capabilities to safeguard its sovereignty and protect its vast interests around the world."

China's Global Superpower Ambitions:

The Xinhua report has for the first time shed light on China's growing concerns with US pivot to Asia which could threaten China's international trade and its economic lifeline of energy and other natural resources it needs to sustain and grow its economy. This concern has been further reinforced by the following:

1. Frequent US statements to "check" China's rise. For example, former US Defense Secretary Leon Panetta said in a 2011 address to the Naval Postgraduate School in California: "We try everything we can to cooperate with these rising powers and to work with them, but to make sure at the same time that they do not threaten stability in the world, to be able to project our power, to be able to say to the world that we continue to be a force to be reckoned with." He added that "we continue to confront rising powers in the world - China, India, Brazil, Russia, countries that we need to cooperate with. We need to hopefully work with. But in the end, we also need to make sure do not threaten the stability of the world."

[TABLE="class: tr-caption-container"]

[TR]

[TD="align: center"]

[/TD]

[/TD][/TR]

[TR]

[TD="class: tr-caption, align: center"]Source: The Guardian[/TD]

[/TR]

[/TABLE]

2. Chinese strategists see a long chain of islands from Japan in the north, all the way down to Australia, all United States allies, all potential controlling chokepoints that could block Chinese sea lanes and cripple its economy, business and industry.

[TABLE="class: tr-caption-container"]

[TR]

[TD="align: center"]

[/TD]

[/TD][/TR]

[TR]

[TD="class: tr-caption, align: center"]Karakoram Highway-World's Highest Paved International Road at 15000 ft.[/TD]

[/TR]

[/TABLE]

Chinese Premier's emphasis on "connectivity and maritime sectors" and "China-Pakistan economic corridor project" is mainly driven by their paranoia about the US intentions to "check China's rise" It is intended to establish greater maritime presence at Gwadar, located close to the strategic Strait of Hormuz, and to build land routes (motorways, rail links, pipelines) from the Persian Gulf through Pakistan to Western China. This is China's insurance to continue trade with West Asia and the Middle East in case of hostilities with the United States and its allies in Asia.

[TABLE="class: tr-caption-container"]

[TR]

[TD="align: center"]

[/TD]

[/TD][/TR]

[TR]

[TD="class: tr-caption, align: center"]Pakistan's Gawadar Port- located 400 Km from the Strait of Hormuz[/TD]

[/TR]

[/TABLE]

As to the benefits for Pakistanis, expanded trade and the Chinese investment in "connectivity and maritime sectors" and "China-Pakistan economic corridor project" will help build infrastructure, stimulate Pakistan's economy and create millions of badly needed jobs.

Clearly, China-Pakistan ties have now become much more strategic than the US-Pakistan ties, particularly since 2011 because, as American Journalist Mark Mazzetti of New York Times put it, the Obama administration's heavy handed policies "turned Pakistan against the United States". A similar view is offered by a former State Department official Vali Nasr in his book "The Dispensable Nation".

Chinese Checkbook Diplomacy:

China is now the biggest lender to the developing world, surpassing the World Bank set up as an institution by the West to extend its dominance after WWII. China's checkbook diplomacy is bearing fruit with its growing trade making it the biggest trading partner of a growing number of countries and regions. As China surpasses the United States as the largest economy and its trade volume explodes, it is very likely that the RMB (Yuan), the Chinese currency, will replace the US dollar as the world's main trade and reserve currency.

Between 2001 and 2010, China’s Export-Import Bank extended $62.7 billion in loans to African nations, or $12.5 billion more than the World Bank, according to Forbes magazine. Over the same period, trade between Africa and China grew by more than 700 per cent with China replacing the U.S. as Africa’s biggest trading partner in 2009.

Summary:

History is filled with examples of great powers using trade and exports to extend their power and influence across the world. China appears to be taking a page from their playbook in pursuit of massive trade growth through check-book diplomacy in Africa, South Asia and South America.

http://www.riazhaq.com/2014/09/does-china-seek-to-dominate-india.html

Last edited: