http://www.riazhaq.com/2013/08/india-suffers-rapid-loss-of-investor.html

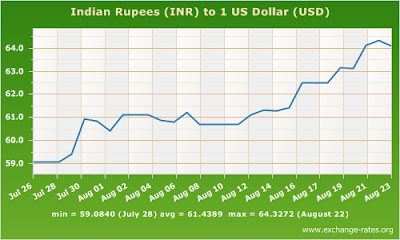

Plummeting Indian rupee is the most obvious symptom of the world losing confidence in India. The crisis of confidence is so great that Jim O'Neill, former Goldman Sachs executive whose BRIC acronym made India an attractive investor destination in 2001, has recently said that if I were to change it, I would just leave the "C"" in BRIC.

India has long run huge twin deficits which it has been able to finance with foreign capital inflows. Such flows have been driven mainly by the easy money policies pursued by the US Federal Reserve and other central banks in Europe and Japan in recent years.

The US Fed in Washington has been buying $85 billion worth of bonds with a few computer key strokes every month to stimulate the US economy.

Many investors had been borrowing money in US dollars at extremely low rates to invest their borrowings for higher returns in emerging markets like India. With US economic recovery beginning to take hold, the US Fed has signaled that it may reduce or end these bond purchases. As a result of this change, foreign investors are retrenching from the emerging markets to take advantage of better returns in US and frontier markets.

In contrast to big declines in emerging markets like India and Indonesia, some frontier markets such as the UAE, Bulgaria and Pakistan have returned over 50 percent this year in dollar terms, according to Reuters. Unlike in the big emerging economies, listed companies in Kenya or Pakistan tend to be true plays on the emerging market consumer. Earnings growth estimates for this year have risen sharply almost everywhere to 10-15 percent (versus the 9.8 percent average in emerging markets)

In addition to the stellar performance of Karachi's KSE-100 this year, Pakistani euro bonds listed on the Luxembourg stock exchange are also doing well, according to Pakistan's Dawn newspaper. In the last four months, these bonds have surged by more than 10 per cent (excluding coupon payment), which places them among the best performing in emerging and frontier markets. During this period, yields on the bonds have declined by more than 300 basis points.

India and Indonesia have been specially hard hit because both are dependent on significant foreign inflows to fill their current-account gaps. Foreign investors have already sold a net $11.6 billion of Indian debt and equities since late May, sparking fears of continued weakness, according to Reuters. As a result, Indian rupee and major Indian stock indices have both suffered double digit losses this year. Weakness in the Indian currency, which tumbled almost 15 percent this year, could further fuel inflation, and hurt consumers in an election year. Compared to 2011-12, the Indian GDP has declined by more than $200 billion to about $1.65 trillion this year.

The Reserve Bank of India (RBI), the country's central bank, has said it plans to buy long-dated government debt to stabilize markets after rising volatility threatened to hurt an economy that is already growing at the slowest pace in a decade. But the BRI actions appear to be too little too late.

There does not appear to be any quick fix to the falling rupee and declining investor confidence. The longer term solution lies in containing both the budget and the trade deficits. It will require strong political will to cut spending and reduce imports in the immediate future. Such actions will make the situation worse before it hets better. Will India's ruling politicians muster the courage to swallow the bitter pill so close to the upcoming elections in 2014? I doubt it.

http://www.riazhaq.com/2013/08/india-suffers-rapid-loss-of-investor.html

Plummeting Indian rupee is the most obvious symptom of the world losing confidence in India. The crisis of confidence is so great that Jim O'Neill, former Goldman Sachs executive whose BRIC acronym made India an attractive investor destination in 2001, has recently said that if I were to change it, I would just leave the "C"" in BRIC.

India has long run huge twin deficits which it has been able to finance with foreign capital inflows. Such flows have been driven mainly by the easy money policies pursued by the US Federal Reserve and other central banks in Europe and Japan in recent years.

The US Fed in Washington has been buying $85 billion worth of bonds with a few computer key strokes every month to stimulate the US economy.

Many investors had been borrowing money in US dollars at extremely low rates to invest their borrowings for higher returns in emerging markets like India. With US economic recovery beginning to take hold, the US Fed has signaled that it may reduce or end these bond purchases. As a result of this change, foreign investors are retrenching from the emerging markets to take advantage of better returns in US and frontier markets.

In contrast to big declines in emerging markets like India and Indonesia, some frontier markets such as the UAE, Bulgaria and Pakistan have returned over 50 percent this year in dollar terms, according to Reuters. Unlike in the big emerging economies, listed companies in Kenya or Pakistan tend to be true plays on the emerging market consumer. Earnings growth estimates for this year have risen sharply almost everywhere to 10-15 percent (versus the 9.8 percent average in emerging markets)

In addition to the stellar performance of Karachi's KSE-100 this year, Pakistani euro bonds listed on the Luxembourg stock exchange are also doing well, according to Pakistan's Dawn newspaper. In the last four months, these bonds have surged by more than 10 per cent (excluding coupon payment), which places them among the best performing in emerging and frontier markets. During this period, yields on the bonds have declined by more than 300 basis points.

India and Indonesia have been specially hard hit because both are dependent on significant foreign inflows to fill their current-account gaps. Foreign investors have already sold a net $11.6 billion of Indian debt and equities since late May, sparking fears of continued weakness, according to Reuters. As a result, Indian rupee and major Indian stock indices have both suffered double digit losses this year. Weakness in the Indian currency, which tumbled almost 15 percent this year, could further fuel inflation, and hurt consumers in an election year. Compared to 2011-12, the Indian GDP has declined by more than $200 billion to about $1.65 trillion this year.

The Reserve Bank of India (RBI), the country's central bank, has said it plans to buy long-dated government debt to stabilize markets after rising volatility threatened to hurt an economy that is already growing at the slowest pace in a decade. But the BRI actions appear to be too little too late.

There does not appear to be any quick fix to the falling rupee and declining investor confidence. The longer term solution lies in containing both the budget and the trade deficits. It will require strong political will to cut spending and reduce imports in the immediate future. Such actions will make the situation worse before it hets better. Will India's ruling politicians muster the courage to swallow the bitter pill so close to the upcoming elections in 2014? I doubt it.

http://www.riazhaq.com/2013/08/india-suffers-rapid-loss-of-investor.html