RiazHaq

Senator (1k+ posts)

http://www.riazhaq.com/2019/04/current-debt-crisis-threatens-pakistans.html

Pakistan is battling massive twin deficits, deteriorating foreign currency reserves, low exports, diminishing tax revenues, a weak currency, unsustainable external debt payments, and soaring sovereign debt. This crises has forced the country to seek IMF (International Monetary Fund) bailout, the 13th such request in Pakistan's 72 year history.

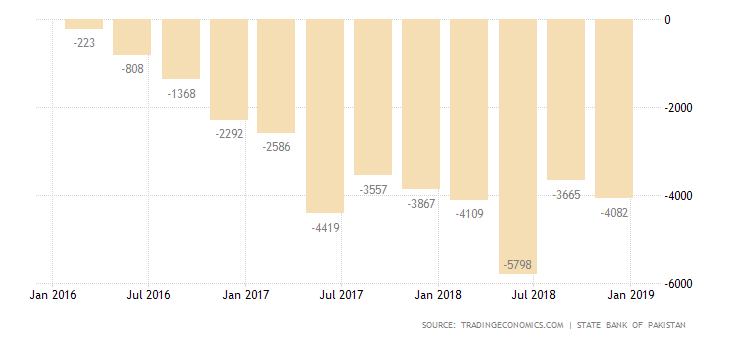

Pakistan's debt repayment costs rose to $5.4 billion for first half of fiscal 2019 ( July 2018-Dec 2018), up from $7.5 billion for the entire fiscal 2018 (July 2017-June 2018), according to the State Bank of Pakistan. At this rate, the total debt service cost for current fiscal 2019 will exceed $11 billion, adding to the nation's debt crisis.

This $11 billion debt service cost will add to the projected trade deficit of nearly $40 billion for the current fiscal year. How can Pakistan fill this balance of payments deficit of about $50 billion? Remittances of $21 billion in current FY2019 from Pakistani diaspora are reduce it to $30 billion. PTI government has taken on billions of dollars in loans from Gulf Arabs and China. Given the low rates of foreign investments in the country, a big chunk of the remaining deficit will have to be met by borrowing even more funds which will further increase future debt service costs.

As a result, Pakistan is now battling massive twin deficits, deteriorating foreign currency reserves, low exports, diminishing tax revenues, a weak currency, onerous external debt payments, and soaring sovereign debt. This crises has forced the country to seek IMF (International Monetary Fund) bailout, the 13th such request in Pakistan's 72 year history.

In the short term, PTI government's efforts are beginning to pay off. The current account deficit (CAD) in first 8 months of FY2019 (July-Feb 2018) declined to $8.844 billion, down 22.5%, from $11.421 billion in same period last year, according to SBP as reported by Dawn newspaper.

However, Pakistan's economic woes are far from over. The country's twin deficits are structural. Its exports and tax collections as percentage of its GDP are among the lowest in the world. British civil society organization Jubilee Debt Campaign conducted research in 2017 that showed that Pakistan has received IMF loans in 30 of the last 42 years, making this one of the most sustained periods of lending to any country.

Pakistan needs to find a way to build up and manage significant dollar reserves to avoid recurring IMF bailouts. The best way to do it is to focus on increasing the country's exports that have remained essentially flat in absolute dollars and declined as percentage of GDP over the last 5 years. Pakistan's economic attaches posted at the nation's embassies need to focus on all export opportunities in international markets and help educate Pakistani businesses on the best way to take advantage of them. This needs to be concerted effort involving various government ministries and departments working closely with industry groups. At the same time, the new government needs to crack down on illicit outflow of dollars from the country.

Azad Labon Ke Sath host Faraz Darvesh discusses Imran Khan's challenges with Misbah Azam and Riaz Haq (www.riazhaq.com)

http://www.riazhaq.com/2019/04/current-debt-crisis-threatens-pakistans.html

Pakistan is battling massive twin deficits, deteriorating foreign currency reserves, low exports, diminishing tax revenues, a weak currency, unsustainable external debt payments, and soaring sovereign debt. This crises has forced the country to seek IMF (International Monetary Fund) bailout, the 13th such request in Pakistan's 72 year history.

Pakistan's debt repayment costs rose to $5.4 billion for first half of fiscal 2019 ( July 2018-Dec 2018), up from $7.5 billion for the entire fiscal 2018 (July 2017-June 2018), according to the State Bank of Pakistan. At this rate, the total debt service cost for current fiscal 2019 will exceed $11 billion, adding to the nation's debt crisis.

This $11 billion debt service cost will add to the projected trade deficit of nearly $40 billion for the current fiscal year. How can Pakistan fill this balance of payments deficit of about $50 billion? Remittances of $21 billion in current FY2019 from Pakistani diaspora are reduce it to $30 billion. PTI government has taken on billions of dollars in loans from Gulf Arabs and China. Given the low rates of foreign investments in the country, a big chunk of the remaining deficit will have to be met by borrowing even more funds which will further increase future debt service costs.

As a result, Pakistan is now battling massive twin deficits, deteriorating foreign currency reserves, low exports, diminishing tax revenues, a weak currency, onerous external debt payments, and soaring sovereign debt. This crises has forced the country to seek IMF (International Monetary Fund) bailout, the 13th such request in Pakistan's 72 year history.

In the short term, PTI government's efforts are beginning to pay off. The current account deficit (CAD) in first 8 months of FY2019 (July-Feb 2018) declined to $8.844 billion, down 22.5%, from $11.421 billion in same period last year, according to SBP as reported by Dawn newspaper.

However, Pakistan's economic woes are far from over. The country's twin deficits are structural. Its exports and tax collections as percentage of its GDP are among the lowest in the world. British civil society organization Jubilee Debt Campaign conducted research in 2017 that showed that Pakistan has received IMF loans in 30 of the last 42 years, making this one of the most sustained periods of lending to any country.

Pakistan needs to find a way to build up and manage significant dollar reserves to avoid recurring IMF bailouts. The best way to do it is to focus on increasing the country's exports that have remained essentially flat in absolute dollars and declined as percentage of GDP over the last 5 years. Pakistan's economic attaches posted at the nation's embassies need to focus on all export opportunities in international markets and help educate Pakistani businesses on the best way to take advantage of them. This needs to be concerted effort involving various government ministries and departments working closely with industry groups. At the same time, the new government needs to crack down on illicit outflow of dollars from the country.

Azad Labon Ke Sath host Faraz Darvesh discusses Imran Khan's challenges with Misbah Azam and Riaz Haq (www.riazhaq.com)

http://www.riazhaq.com/2019/04/current-debt-crisis-threatens-pakistans.html

Last edited by a moderator: