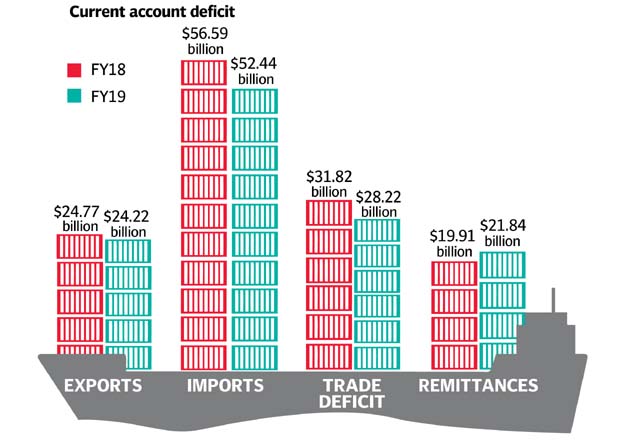

The current account deficit has recorded a massive reduction of $6.3 billion in the closing financial year 2018-19 mainly due to the gradual control over imports and an increase in the inflows of remittances throughout the year.

According to the data released by State Bank of Pakistan (SBP), the current account deficit reduced from $19.89 billion to $13.58 billion.

The reduction in current account deficit value, is more than the $6 billion bailout package signed with International Monetary Fund (IMF) however the incumbent government missed the highly ambitious target to contain the deficit to $6 billion.

The government took strict measures to improve the ballooning deficit over the period while it did succeed to a great extent, it will likely reap benefits to the economy in the current financial year as well.

The imports of luxury items were reduced through high regulatory duties by the government. The government tightened the policy of imports on luxury cars and use of banking services such as credit cars for international transactions.

The overall imports of goods and services saw a drop of over $6 billion which made a difference in the balance sheet of the country. Disappointingly, exports of goods and services did not show any growth in FY19, which is a major concern for the economy.

On the other hand, the government also introduced incentivized services for expatriates supporting remittances to Pakistan, which bode well as the remittances from various countries recorded an all-time high of over $21 billion in FY19.

What’s Next?

The government is taking all possible measures to curtail the imports bills and the imbalance for the payments. Some of the measures will reap the benefit to the economy in the coming years.

The deferred payment facility signed with Saudi Arabia’s government is one of the factors to reduce the deficit. Besides, the currency swap agreement with China may also help the government in reducing the deficit as well. The exports might perform well in the next few years supported by the measures of the government and the remittance inflows will improve further to narrow down the deficit.

These factors will collectively help improve the balance of payment situation of the country and the target to reduce it to $6 billion might be attained by next year.

propakistani.pk

propakistani.pk

According to the data released by State Bank of Pakistan (SBP), the current account deficit reduced from $19.89 billion to $13.58 billion.

The reduction in current account deficit value, is more than the $6 billion bailout package signed with International Monetary Fund (IMF) however the incumbent government missed the highly ambitious target to contain the deficit to $6 billion.

The government took strict measures to improve the ballooning deficit over the period while it did succeed to a great extent, it will likely reap benefits to the economy in the current financial year as well.

The imports of luxury items were reduced through high regulatory duties by the government. The government tightened the policy of imports on luxury cars and use of banking services such as credit cars for international transactions.

The overall imports of goods and services saw a drop of over $6 billion which made a difference in the balance sheet of the country. Disappointingly, exports of goods and services did not show any growth in FY19, which is a major concern for the economy.

On the other hand, the government also introduced incentivized services for expatriates supporting remittances to Pakistan, which bode well as the remittances from various countries recorded an all-time high of over $21 billion in FY19.

What’s Next?

The government is taking all possible measures to curtail the imports bills and the imbalance for the payments. Some of the measures will reap the benefit to the economy in the coming years.

The deferred payment facility signed with Saudi Arabia’s government is one of the factors to reduce the deficit. Besides, the currency swap agreement with China may also help the government in reducing the deficit as well. The exports might perform well in the next few years supported by the measures of the government and the remittance inflows will improve further to narrow down the deficit.

These factors will collectively help improve the balance of payment situation of the country and the target to reduce it to $6 billion might be attained by next year.

Govt's Current Account Deficit Reduction in FY19 Was More Than the IMF Bailout Package

The current account deficit has recorded a massive reduction of $6.3 billion in the closing financial year 2018-19 mainly due